x

READY TO BECOME A MEMBER?

Stay up to date on the digital shelf.

x

THANK YOU!

READY TO BECOME A MEMBER?

THANK YOU!

"You never want a serious crisis to go to waste. And what I mean by that is an opportunity to do things that you think you could not do before."

— Rahm Emanuel, American Politician and Former Mayor of Chicago

Some people attribute this quote to Churchill. But based on my research, that’s a result of what is called “Churchillian Drift,” where it just sounds like something he must have said.

Turns out, it was Rahm.

In any event, this quote rang through my head as I read through a recent McKinsey report: “The Great Acceleration.” I thought the analysis and data from authors Chris Bradley, Martin Hirt, Sara Hudson, Nicholas Northcote, and Sven Smit was sharp, and thought an overview would be useful to those of you in the midst of driving rapid change at your companies.

1. The pandemic and economic crisis is indeed accelerating existing trends.

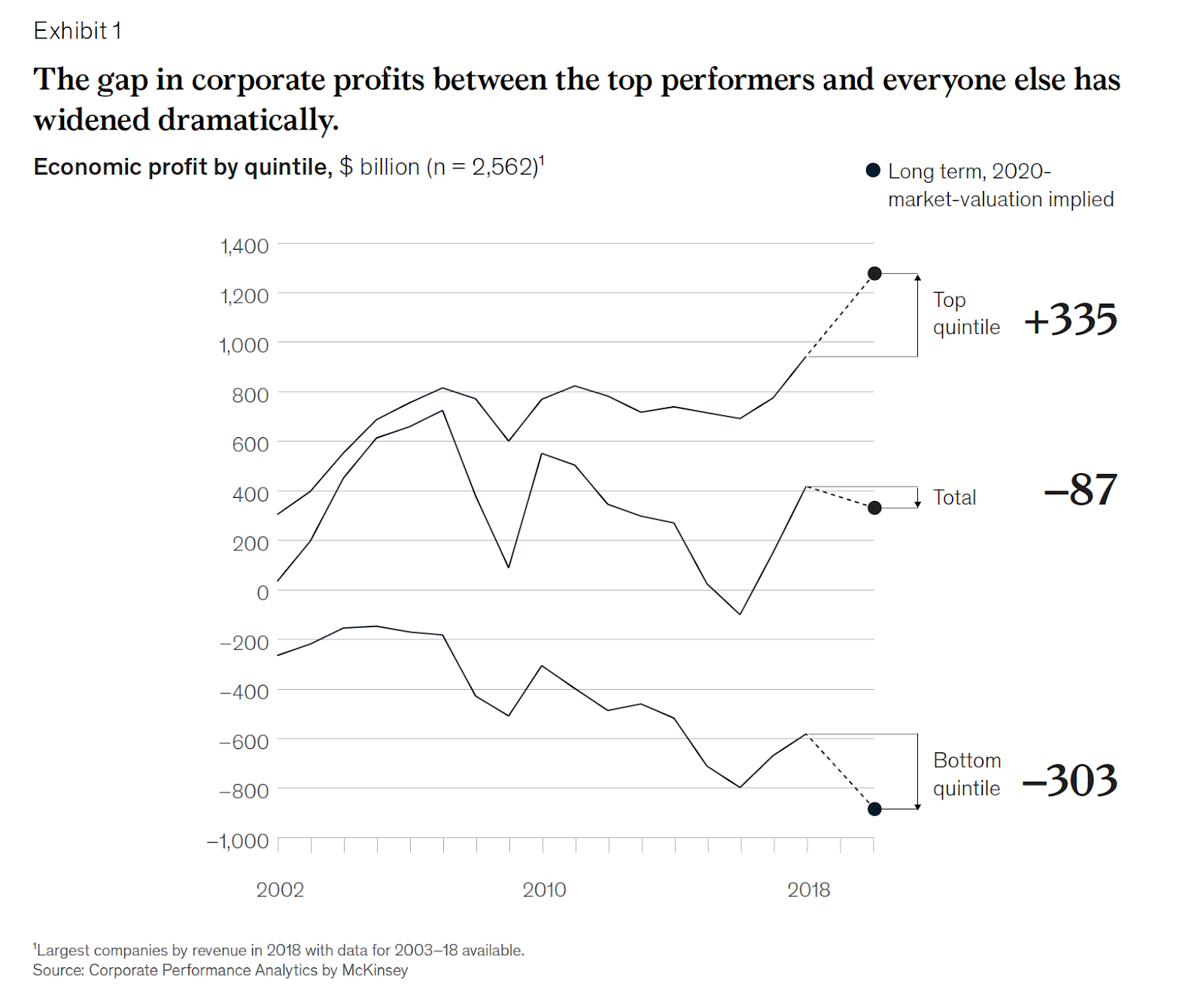

McKinsey analyzed “changes in market capitalization to calculate market-implied long term economic profit for the largest companies globally.”

The report acknowledged that share prices may not be the perfect indicator of the new reality, but stressed how they could be used to identify patterns rather than focusing on the particular market-capitalization levels.

“And those patterns are meaningful, consistent across measurement periods and with our clients’ experience, and very different from what we saw during the global financial crisis of 2008–09.”

2. The “Widening Chasm” is also accelerating.

The period from December 2019 to May 2020 has accelerated the trend we were already seeing: “the growing gap in profit between the top corporate performers and everyone else has widened dramatically.”

3. The “Big Unfreeze” of budgets.

Back to Rahm’s quote about not wasting a crisis: In many conversations I have had with brand leaders at this time, many of them have spoken of this crisis breaking down corporate inertia, organizational silos, and budgetary walls to bias toward testing and action.

McKinsey sees the same trend: “In times of crisis, however, the burning platform is clear, leaders are often in military-command mode, and pre-crisis budgets have become obsolete.”

The authors break the likely opportunities down into three quintiles:

1. Top quintile (of economic profit): It’s the “opportunity of a lifetime.”

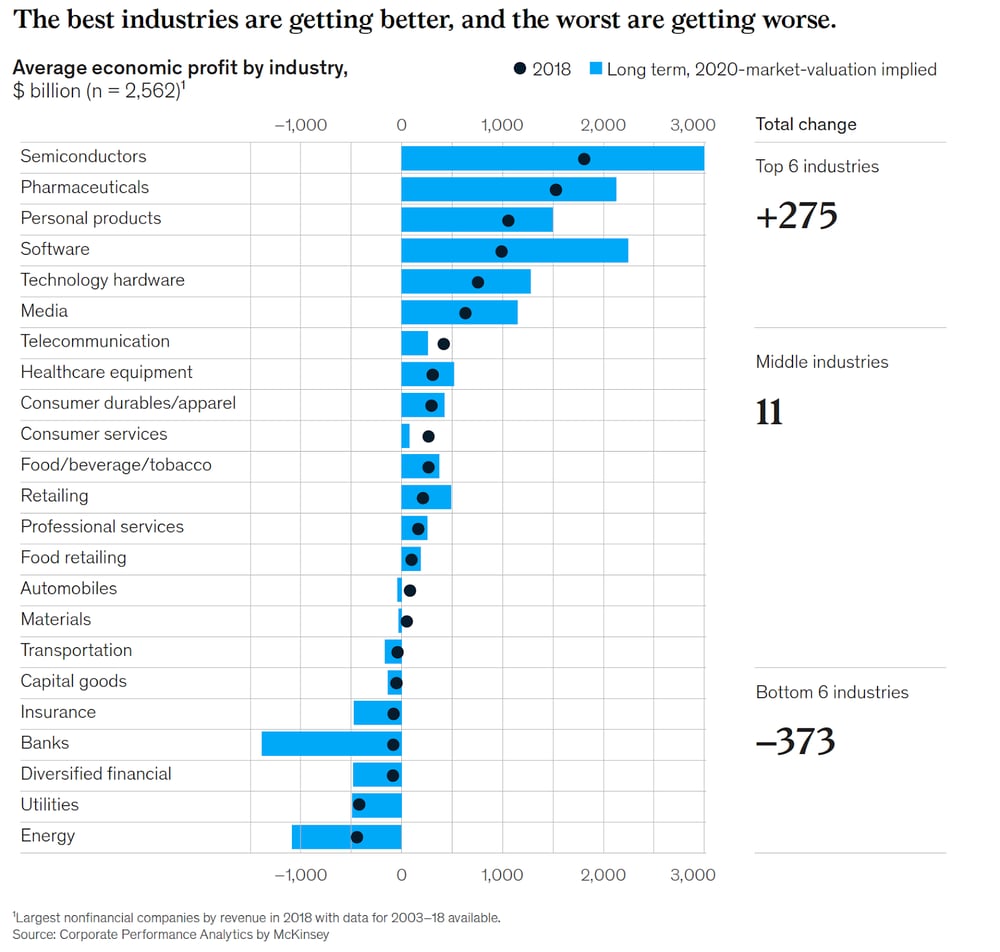

Some manufacturing sectors like pharma and personal products are sitting in this seat, and McKinsey urges them to seize it.

“Manufacturers of some hygiene-related products are aggressively expanding production capacity for the coming year. Pharmaceutical companies are reinventing their production- and regulatory-management systems to accommodate soaring demand."

They highlight those ecommerce leaders that are unleashing “massive through-cycle spending on infrastructure, capacity, and even brand-portfolio expansion.”

2. Middle quintile.

To avoid staying stuck in the middle, McKinsey urges these organizations to reallocate resources to new growth businesses. They observe companies driving ahead with large digital- and analytics-transformation programs that had been delayed.

I’m not oblivious to the fact that McKinsey is a firm that offers large-dollar consulting engagements to drive these transformation projects, but this bias does not negate the trends they cite, and the urgency for these firms to innovate.

3. Bottom quintile.

To avoid continuing to fall further, McKinsey suggests “radical portfolio or industry restructuring.” “Companies that outperformed in the 2008–09 financial crisis divested underperforming businesses 10% faster than their peers did.”

Download the full McKinsey report to gain deeper insights into their latest findings.